Our objective is to provide appropriate and functional premises for our customers efficiently and on a long-term basis. The main principles of financial responsibility include both the long-term financial policy and responsibility towards funding providers. They are the prerequisites for the success of our main mission.

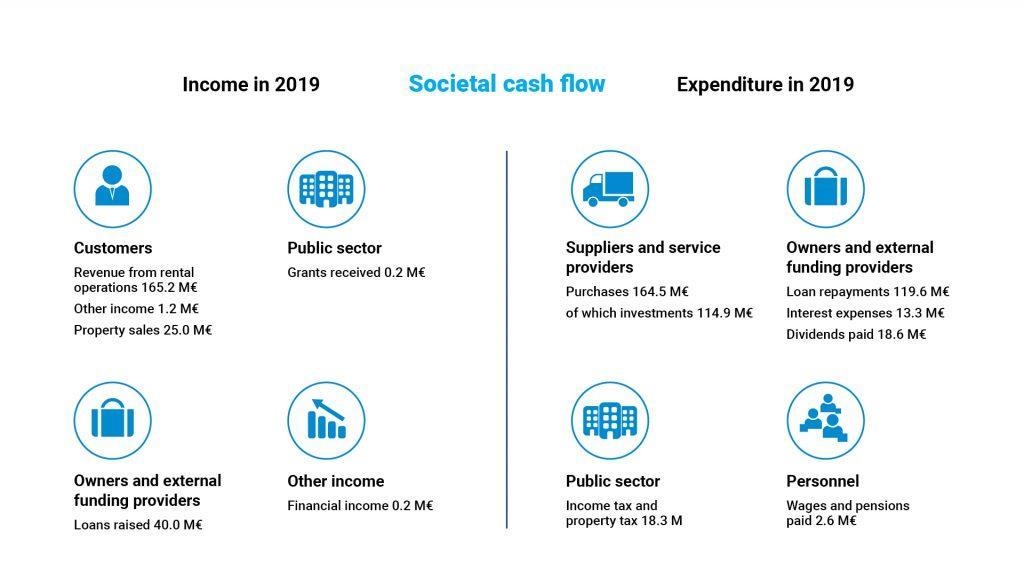

The procurement of services and materials, personnel expenses, income and property taxes paid, dividends and investments constitute SYK’s direct financial impacts. We regularly monitor our financial and operational indicators, such as our project situation and energy consumption.

We ensure a sustainable basis for our operations and minimise the risks of operations by committing to the agreed upon project programmes, and the principles of sustainable development, as well as by taking care of our responsibilities in a timely manner. The implementation of even extensive investment projects is secured by seeking a financially advantageous funding basis with manageable risks.

SYK’s employment effect in 2019 amounted to approximately 2,420 man-years. The company has 30 employees, which means that the employment effect of our investments and purchases is significant. These figures are based on the maintenance and investment expenses shown in the company’s income statement, and the have been converted into the employment effect figure using KTI Property Information’s maintenance cost comparisons and, with respect to investments, statistics provided by the Confederation of Finnish Construction Industries RT.

We are one of the largest payers of property taxes in all the municipalities we operate in, and in the Pirkanmaa economic area, we are one of the largest payers of corporate income tax. In 2019, SYK paid a total of EUR 22.7 million in taxes, of which property taxes represented 55 per cent. We paid property taxes in 16 municipalities, totalling EUR 12.4 million. All taxes were paid in Finland.

Taxes

University Properties of Finland Ltd operates in Finland and pays all of its taxes in Finland. Our tax footprint reflects the significant indirect and direct taxes paid by SYK Group, as well as the taxes deducted from employees’ salaries.

The taxes we paid in 2019 were as follows: property tax EUR 12.4 million, income tax EUR 5.8 million, VAT EUR 4.4 million and withholding tax EUR 0.8 million . The property tax and income tax are clearly the largest tax items. Property tax is a substantial expense item in our expense structure, and it is spread broadly across Finland. For more information, please see the chart on property taxes by municipality.

Our company does not have a separate tax strategy. The finance unit is in charge of tax affairs. We engage in active efforts to prevent the shadow economy, financial crime and tax evasion. We also expect the same responsibility from our partner network.

The tax footprint consists of three primary categories:

- Direct taxes (e.g. income taxes, various employer’s contributions, asset transfer taxes, property taxes, etc.)

- Indirect taxes (taxes paid by the company as part of the price of a service or product but remitted by the seller, e.g. tax on insurance premiums, etc.)

- Remitted taxes (e.g. taxes deducted from salaries, tax at source, VAT).

Property taxes by municipality

Other municipalities:

Ii: 556 €, Kaarina: 3 627 €, Konnevesi: 17 257 €, Kuusamo: 6 298 €, Savonlinna: 47 833 €

- Hämeenlinna: 0.1M€

- Joensuu: 0.7M€

- Jyväskylä: 1.8M€

- Kuopio: 1.0M€

- Lappeenranta: 0.6M€

- Oulu: 2.4M€

- Rauma: 0.1M€

- Rovaniemi: 0.8M€

- Tampere: 2.8M€

- Turku: 1.8M€

- Vaasa: 0.2M€

Direct and remitted taxes paid by SYK Group

| M € | % | |

|---|---|---|

| VAT | 4,4 | 19,6 |

| Property tax | 12,4 | 54,7 |

| Income taxes | 5,8 | 25,7 |

| Total | 22,7 | 100 |

| Withholding | 0,8 |

Real estate assets

By grouping our properties into portfolios in accordance with our strategy and carefully allocating our investments, we ensure the development of our solvency and our ability to secure competitive financing.

The operation of universities and the aim of our owners constitute the core of our real estate strategy. Our real estate assets are concentrated in the major campuses, and we focus on serving the real estate requirements of educational institutes. We have divested any buildings that do not serve this purpose.

The responsible management of our real estate assets also indirectly creates wellbeing throughout Finland.

Purchases by category

- Repairs (22.4 %): 13.9M€

- Use and maintenance (20.4 %): 12.6M€

- Property taxes (20.1 %): 12.4M€

- Heating (18.1 %): 11.2M€

- Administration (10.7 %): 6.6M€

- Gas and electricity (2.3 %): 1.4M€

- Water and sewage (2.0 %): 1.2M€

- Rental expenses (1.8 %): 1.1M€

- Waste management (1.4 %): 0.8M€

- Maintenance of outdoor areas(0.8 %): 0.5M€

- Cleaning (0.3 %): 0.2M€

- Liability insurance (0.3 %): 0.2M€

- Other maintenance costs (-0.5 %): -0.3M€

Campus development

In campus development, responsibility means that the vitality of campuses is maintained and functions are also developed with ecological responsibility in mind. Awareness of the importance of campuses as part of the cities’ overall infrastructure lies at the core of regional development work. We develop new life to campuses in the long term by finding suitable functions or actors for vacating premises.

The smart deployment of resources, reconditioning of existing premises to meet the current and future requirements, as well as constructing new square metres in moderation are all part of our responsible campus development. Whenever possible, we seek to preserve the cultural heritage of campuses. Preserving the cultural heritage and transferring it to new generations is also part of responsible campus development.

Spatial efficiency

Together with universities, we have developed shared-use multi-purpose premises that are not exclusively intended for specific user groups or activities. The universities have studied and investigated their genuine need for premises by using various analytical methods. Efficient use of premises and resources is the future of learning environments and laboratories.

We seek to promote the synergies between various operators, while maximising the amount of time our premises are used. The transition from individual working rooms and large underused meeting and conference facilities to multi-purpose offices is enabled on the basis of the premises adapting to the work and its requirements. That allows the users of premises to utilise open and closed premises, according to their needs at any one time. Efficient planning reduces the idle use of premises and helps to optimise the level of reconditioning work.

Sustainable development indicators

| 2019 | 2018 | 2017 | 2016 | Unit | |

|---|---|---|---|---|---|

| Revenue | 165,2 | 159,5 | 150,1 | 148,2 | M € |

| Return on equity | 3 | 3 | 2,6 | 2,8 | % |

| Balance sheet total | 1 335,0 | 1 357,1 | 1 268,8 | 1 226,8 | M € |

| Value of investments | 114,9 | 95,4 | 116,3 | 95,8 | M € |

| Tax footprint, total taxes | 22,7 | 23,6 | 20,9 | 22,3 | M € |

Development of revenue 2015–2019

Development of profit 2015–2019